box 7 distribution code Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . Find out what these are and how to wire up a spur socket below. What is a Spur Socket. A spur socket is where an existing radial circuit or ring main is tapped into with new wires via a junction box or socket and a feed is taken to supply a new socket in a new location.

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Each AccuForm compact CNC wire bending machine can currently have up to 3 motion axes, depending on the machine configuration. These machines take wire directly from coil, straighten it, bend it, and cut it to create wire products .

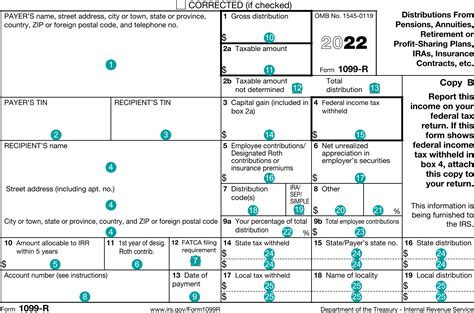

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

pension distribution codes

irs roth distribution codes

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not .Box 7. Distribution Code(s) Enter an “X” in the IRA/SEP/SIMPLE checkbox if the distribution is from a traditional IRA, SEP IRA, or SIMPLE IRA. Do not check the box for a distribution from a .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal .The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andBox 7. Distribution Code(s) Enter an “X” in the IRA/SEP/SIMPLE checkbox if the distribution is from a traditional IRA, SEP IRA, or SIMPLE IRA. Do not check the box for a distribution from a Roth IRA or for an IRA recharacterization.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal distribution. The distribution is after age 59 1/2. B (Designated .

irs pension distribution codes

The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andBox 7. Distribution Code(s) Enter an “X” in the IRA/SEP/SIMPLE checkbox if the distribution is from a traditional IRA, SEP IRA, or SIMPLE IRA. Do not check the box for a distribution from a Roth IRA or for an IRA recharacterization.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal distribution. The distribution is after age 59 1/2. B (Designated .

$34.98

box 7 distribution code|1099 r 7d distribution code