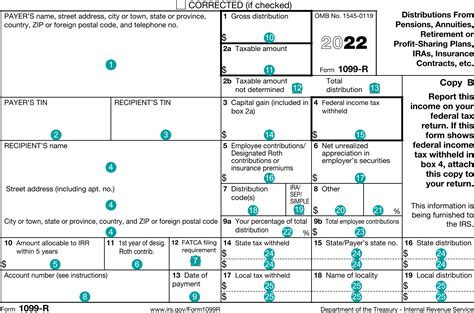

box 7 distribution codes If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

Galvanized steel is the result of applying a protective zinc coating to steel to prevent it from rusting

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

The phone box, which is also known as the network interface device (NID), is installed by the telephone company, and it's where the main phone lines coming from a pole or from underground terminate. The NID belongs to the telephone company, and you, the customer, aren't allowed access to all of it.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

Learn how to report different types of distributions from pensions, annuities, retirement plans, IRAs, and insurance contracts on Form 1099-R. Find out the meaning of the box 7 codes, .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . The following chart provides the distribution codes for Box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. If more than two .

Box 7 on Form 1099-R contains distribution codes that help taxpayers and the IRS understand the nature of the distribution. These codes are essential for accurately reporting the distribution on the taxpayer's tax return .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andAre you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form 1099-R on your tax returnBox 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). The following chart provides the distribution codes for Box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. If more than two codes apply, two 1099-Rs may be required. Common examples include .

pension distribution codes

Box 7 on Form 1099-R contains distribution codes that help taxpayers and the IRS understand the nature of the distribution. These codes are essential for accurately reporting the distribution on the taxpayer's tax return and determining the appropriate tax treatment.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

decorative metal sheets canada

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA). The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form 1099-R on your tax return

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). The following chart provides the distribution codes for Box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. If more than two codes apply, two 1099-Rs may be required. Common examples include .

irs roth distribution codes

irs pension distribution codes

Learn critical machining skills in just 36 weeks with our CNC Machining Technology program. Apply today to start your CNC training!

box 7 distribution codes|box 7 1099 r