distribution box 7 code e Use Code E for a section 415 distribution under EPCRS or Code H for a direct rollover to a Roth IRA The ZVEX Box of Metal is an aggressive high-gain pedal with a highly-effective built-in switchable gate which dramatically reduces noise and unwanted feedback. It is available in Vexter (2-year warranty) and hand-painted (lifetime warranty) versions.

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Скачать Real Steel World Robot Boxing [Unlocked/много денег/без рекламы] MOD на андроид. Новая часть робо-файтинга по мотивам фильма

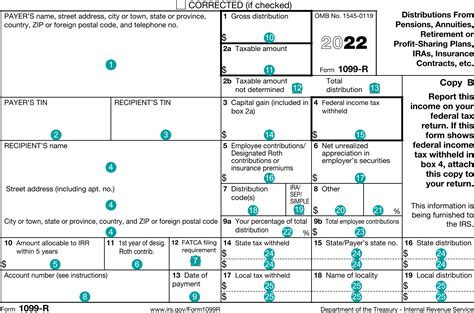

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .For a direct rollover of a distribution from a designated Roth account to a Roth IRA, enter the amount rolled over in box 1 and 0 (zero) in box 2a. Use Code H in box 7. For all other .Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not .

Use Code E for a section 415 distribution under EPCRS or Code H for a direct rollover to a Roth IRA Use code E, Distributions under Employee Plans Compliance Resolution System (EPCRS), if excess employer contributions and applicable earnings under a SEP or SIMPLE IRA plan are returned to the employer (with .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . The client received two Form 1099R’s: One for ,000 showing Code G (Direct Rollover), and a second one for ,000 showing Code E (Distributions Under Employee Plans .

Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.For a direct rollover of a distribution from a designated Roth account to a Roth IRA, enter the amount rolled over in box 1 and 0 (zero) in box 2a. Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

Use Code E for a section 415 distribution under EPCRS or Code H for a direct rollover to a Roth IRA Use code E, Distributions under Employee Plans Compliance Resolution System (EPCRS), if excess employer contributions and applicable earnings under a SEP or SIMPLE IRA plan are returned to the employer (with the IRA owner’s consent).Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). The client received two Form 1099R’s: One for ,000 showing Code G (Direct Rollover), and a second one for ,000 showing Code E (Distributions Under Employee Plans Compliance Resolution System). Are there any tax savvy tips to . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another account. By knowing what each code means, you can accurately report your distribution on your tax return. .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

For a direct rollover of a distribution from a designated Roth account to a Roth IRA, enter the amount rolled over in box 1 and 0 (zero) in box 2a. Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

Use Code E for a section 415 distribution under EPCRS or Code H for a direct rollover to a Roth IRA Use code E, Distributions under Employee Plans Compliance Resolution System (EPCRS), if excess employer contributions and applicable earnings under a SEP or SIMPLE IRA plan are returned to the employer (with the IRA owner’s consent).Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

pension distribution codes

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). The client received two Form 1099R’s: One for ,000 showing Code G (Direct Rollover), and a second one for ,000 showing Code E (Distributions Under Employee Plans Compliance Resolution System). Are there any tax savvy tips to .

office designs black steel 2 drawer file cabinet with shelf

oem solar junction box factories

Explore Zurn's Z1 product family, offering a comprehensive range of innovative plumbing solutions. From commercial plumbing systems to sustainable water management, Zurn's Z1 series sets the standard for excellence.

distribution box 7 code e|irs roth distribution codes