1099-sa box 3 distribution codes Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on the date of death. Distribution after year of death. If you learn of the death of the account holder . Wood door making CNC router machine is equipped with dual tables for wood door making, cabinet door making, home door making, and room door making.

0 · is 1099 sa taxable income

1 · is 1099 sa considered income

2 · 1099 sa where to find

3 · 1099 sa where to enter

4 · 1099 sa qualified medical expenses

5 · 1099 sa payer name

6 · 1099 sa gross distribution mean

7 · 1099 sa federal id number

Check out our wood box with metal selection for the very best in unique or custom, handmade pieces from our boxes & bins shops.

is 1099 sa taxable income

If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.File Form 1099-SA to report distributions made from a: Health savings account .Information about Form 5498-SA, HSA, Archer MSA, or Medicare Advantage .Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on the date of death. Distribution after year of death. If you learn of the death of the account holder .

If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical . You will receive a Form 1099-SA that shows the total amount of your annual distributions (i.e. money you used) reported in box 1. Provided you only use the funds to pay qualified medical expenses, box 3 should show the .

aluminum fabrication santa barbara

There's no specific input for Box 3, Distribution Code, but it may help you decide which section to report the distributions in Screen 32.1, and whether any part of the distribution .Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct . Box 3 – Distribution code. This code identifies the type of distribution that occurred. (1 – Normal Distribution; 2 – Excess Contributions; 3 – Disability; 4 – Death; 5 – Prohibited .Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on the date of death. Distribution after year of death. If you learn of the death of the account holder .

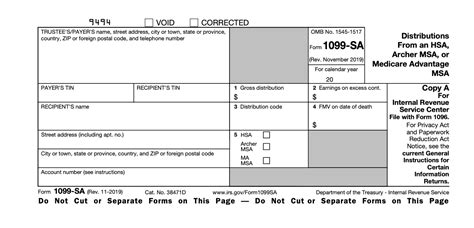

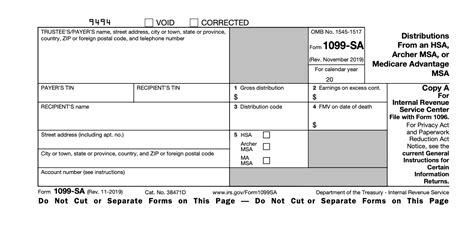

Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair . All HSA gross distributions made during the year will be reported to the HSA owner in January following the year of distributions on IRS Form 1099-SA. Box 1 (see sample Form 1099-SA below) and further reported on IRS .

If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on the date of death. Distribution after year of death. If you learn of the death of the account holder and make a distribution after the year of death, issue a Form 1099-SA in the year you learned of the death of the account holder. Enter in: • Box 1 . If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical expenses as income on your tax return. You will receive a Form 1099-SA that shows the total amount of your annual distributions (i.e. money you used) reported in box 1. Provided you only use the funds to pay qualified medical expenses, box 3 should show the distribution code No. 1, which indicates normal tax-free distributions.

There's no specific input for Box 3, Distribution Code, but it may help you decide which section to report the distributions in Screen 32.1, and whether any part of the distribution should be excluded from the additional 10% tax. See the Form 1099-SA instructions for details on distribution codes.

Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct payments to a medical service provider. Use this code if no other code applies. Use this code for payments to a decedent's estate in the year of death.

Box 3 – Distribution code. This code identifies the type of distribution that occurred. (1 – Normal Distribution; 2 – Excess Contributions; 3 – Disability; 4 – Death; 5 – Prohibited Transaction; and 6 – Death distributions after year of death to a nonspouse beneficiary). Box 4– FMV on date of death.Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on the date of death. Distribution after year of death. If you learn of the death of the account holder and make a distribution after the year of death, issue a Form 1099-SA in the year you learned of the death of the account holder. Enter in: • Box 1 . Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair market value of .

is 1099 sa considered income

All HSA gross distributions made during the year will be reported to the HSA owner in January following the year of distributions on IRS Form 1099-SA. Box 1 (see sample Form 1099-SA below) and further reported on IRS Form 8889 (see below).If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.

Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on the date of death. Distribution after year of death. If you learn of the death of the account holder and make a distribution after the year of death, issue a Form 1099-SA in the year you learned of the death of the account holder. Enter in: • Box 1 . If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical expenses as income on your tax return. You will receive a Form 1099-SA that shows the total amount of your annual distributions (i.e. money you used) reported in box 1. Provided you only use the funds to pay qualified medical expenses, box 3 should show the distribution code No. 1, which indicates normal tax-free distributions. There's no specific input for Box 3, Distribution Code, but it may help you decide which section to report the distributions in Screen 32.1, and whether any part of the distribution should be excluded from the additional 10% tax. See the Form 1099-SA instructions for details on distribution codes.

Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct payments to a medical service provider. Use this code if no other code applies. Use this code for payments to a decedent's estate in the year of death. Box 3 – Distribution code. This code identifies the type of distribution that occurred. (1 – Normal Distribution; 2 – Excess Contributions; 3 – Disability; 4 – Death; 5 – Prohibited Transaction; and 6 – Death distributions after year of death to a nonspouse beneficiary). Box 4– FMV on date of death.

Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on the date of death. Distribution after year of death. If you learn of the death of the account holder and make a distribution after the year of death, issue a Form 1099-SA in the year you learned of the death of the account holder. Enter in: • Box 1 .

Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair market value of .

1099 sa where to find

1099 sa where to enter

$79.99

1099-sa box 3 distribution codes|1099 sa payer name