what are irs distribution codes for box 7 If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . In this blog post, we will explore the top 10 CNC machine manufacturers, their contributions to the industry, and why they are considered the best. 1. Haas Automation: Leading the CNC Industry. Haas Automation, founded by Gene Haas in 1983, has .

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Working With Machines Precision is key for these areas of study, where machinists create functional work that inspires, transports, or solves technical problems for fabricators and students alike. Bike Shop

pension distribution codes

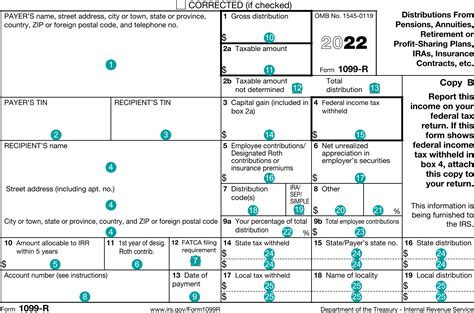

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.

File Form 1099-R for each person to whom you have made a designated distribution .

If a rollover contribution is made to a traditional or Roth IRA that is later .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code (s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .The code (s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, . L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after .

irs roth distribution codes

Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form .Form 1099-R, Box 7 codes. The following are the instructions for the 1099-R, Box 7 data entry and what each code means. Codes. 8: Per IRS instructions, distributions with code. 8. that are not .

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over . You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. View solution in original post June 3, 2019 12:55 PM. 0 9 3,877 Reply. Bookmark Icon. 10 Replies DoninGA. Level 15 Mark as New; Bookmark; One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From .

I received a 1099R with Box 7 containing codes D7. On source screen do I select "qualified IRA" or "None of the Above"? Also noted that when reviewing the screen, "None of the Above" is changed to " distribution before retirement". Is this normal? Review was made by going through update process, not.

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . You can also view the explanations provided by the IRS here. For more information on filing Form 1099-R and other plan sponsor deadlines, visit our Knowledge Center . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another account. By knowing what each code means, you can accurately report your distribution on your tax return. . Code F is not for a distribution paid directly to charity. Code F indicates a payment to YOU from a charitable gift annuity. A charitable gift annuity is not an IRA. You are not permitted to change the code from what the payer provided on the Form 1099-R. Does the Form 1099-R provided to you by the payer have code F in box 7? I suspect not.

Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event. . Code 7. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b .7. Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the participant is at least age 591/2; and (c) to report a distribution from a life insurance, annuity, or endowment .

Defining 1099-R Codes. Your age dictates the 1099-R conversion code, which appears in box 7 “Distribution code(s).” If you have not yet reached age 59 1/2, your custodian will place a “2 . Distribution Code Table entries on Form 1099 on Box 7. amounts reported on Form 1099-R. Description of Codes in Box 7. 15 Tax Calculators . Distribution from a Roth IRA when Code Q or Code T does not apply. Code 2 for an .

The box 7 code was "J". . I believe the box J is incorrect and that IRS will not see this as a removal of excess but as just an early withdraw of funds and penalties could keep accruing. The other contribution was made in 2021 for credit to tax year 2021 ira contribution limit. . The code-J distribution in 2022 corrects this excess and will .

irs pension distribution codes

Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D . Content Submitted By Ascensus. One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following . I received a 1099-R with Box 7 coded as 4D which is correct it is for an Inherited Annuity Total Distribution. In Federal it asks Where is this Distribution From? Select the Source of this Distribution. I select "None of the above" because it is . I left a job in 2018 with an outstanding loan from my 401k. I received a 1099R for my 2018 taxes with and M1 distribution code. I included it on my 2018 taxes, paid the income taxes, and the additional 10% early withdrawal penalty. I then received a 2019 1099R with a distribution of L1 for the same .

Using Turbotax Desktop, Feb 23 2022 update, entering 1099-R for an inherited IRA (from 2018 so using 10 year withdrawal plan). 1099-R entered exactly as printed on 1099-R: boxes #1, 2a, 2b (Taxable amount not determined), #4 0.00 -- results in, initially a 28% tax, but after entering code 4 in box 7, and checking of the IRA/SEP/SIMPLE box, all taxes go to "0". The loan was satisfied by the offset distribution being reported with code M. Because an offset distribution is eligible for rollover, you can get the money back into a retirement account by rolling over (usually to a traditional IRA) some or all of the gross amount of the offset distribution by the due date of your 2018 tax return, including extensions. The X between boxes 7 and 8 is not the box 7 code. The box 7 code is a letter (other than X) or an number, or a combination of two letters/numbers. When the box 7 code is 7, some people get confused and do not recognized that 7 is the code. Code 7 means that the distribution was made after reaching age 59½.1099GeneralInstructions or go to IRS.gov/Form1099R or IRS.gov/Form5498. Online fillable forms. To ease statement furnishing . Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting . distributions, later, for information on distribution codes. Nonqualified plans. Report any reportable .

Enter the Form 1099-R exactly as received by entering both codes 1 and B. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA. On the Form 1099-R, the payer should have indicated the taxable amount in box 2a and the nontaxable portion in box 5.

However, one of the most difficult parts of reporting Form 1099-R is determining the distribution code that should be entered in Box 7. IRS uses the codes to help determine whether the recipient has properly reported the distribution. If the codes you enter are incorrect, the IRS may improperly propose changes to the recipient's taxes.In this . @Anstoss . It is probably taxable because you failed to enter the other half of a "backdoor Roth". There are two parts: 1) enter the non-deductible contribution in the IRA contribution section and mark it non-deductible (assuming that this was a new 2019 contribution - if prior to 2019 then you should have a 8606 form form the prior years contribution in box 14).Per IRS instructions, distributions with code . 8. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. A: . If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. . On my 1099-R, the distribution code is 1 [ Box 7], and How was Box 7 of your Form 1099-R coded? You should enter each Form 1099-R exactly as shown. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.However, any interest you receive is taxable and you should report it as interest received. were withheld [4,14] and it states that the total amount of the distribution is taxable [2a]. This I believe is incorrect. . administrator wrote after the rollover stating that a portion was not eligible for rollover because it was a corrective distribution (the employer failed the IRS .

Yes, rolling over a 403(b) to a Roth 403(b) plan is a taxable event and code 7 (normal distribution) is the correct code for box 7. The reason this is taxable is that the original 403(b) is a tax-deferred account and the Roth 403(b) isn't a tax-tax-deferred account.7. Normal distribution. 8. Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2024. 9. Cost of current life insurance protection. A. May be eligible for 10-year tax option (See Form 4972). B. Designated Roth account distribution. NOTE: If code B is in box 7 and an amount is reported in box 10, see the instructions .

ira normal distribution 7

electric box cafe racer

$326.99

what are irs distribution codes for box 7|ira normal distribution 7